The Components of Corporate Real Estate Management

Oliver Breitenstein, Alexander May, Friedrich Eschenbaum*

The part of real estate assets of companies is in many cases more than 50 % of the total assets depending on the valuation approach and the related specific real estate costs represent the second largest cost factor after the personnel expenses with 5 to 10 % of the total turnover.

This fundamental asset and cost efficiency of corporate real estates has been underestimated up to now and requires strong cost awareness has been enforced in business enterprises as well as in the public sector. Production and administration has been optimized. Organizational methods, e. g. Lean-Management, Just-In-Time, manufacturing segmentation a.s.o. have been a reorganization of the pure functional preserving administration of corporate buildings. In the last years a established in the market. Nevertheless, the real estate sector is treated quite badly by lots of people. Due to more and more difficult cyclical influences and an increasing cost-push it is the time to optimize this pool of costs.

The term Corporate Real Estate originated in the USA

Real estate - also known as fifth resource of a company - after work, capital, technology and information will be involved in the company’s policy with the philosophy CRE as a strategic management technique.

Basic considerations are the representation and development of increase in value potential for not operating areas and reversed, a exploitation of cost reduction potentials for operating areas and objectes.

The objective of CRE is the making of a return from real estate without changing the head branch of a business. Furthermore, the Corporate Real Estate Management is able to make a contribution for the securing and strengthening of the competitiveness of a company - in principle, real estate offers lots of possibilities.

Strategies and methods of CRE should make a contribution that company objectives will be supported and finally reached better. Company-owned resources will be used more intensively, costs will be reduced and synergy potentials will be shown.

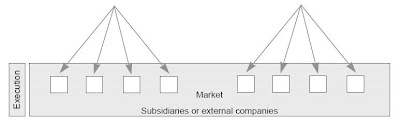

CRE means the bringing in of specific real estate knowledge in the field of corporate real estate (according to fig. 1).

The objective is an increasing profitability of the company.

The substantial tasks of CRE can be divided into four groups:

Wording of real estate-related objectives and strategies for setting up the developing direction of the real estate dimension of a company and adaptation to changing environmental conditions.

Optimal utilization and allocation of real estate-related resources and capacities from the real estate field (consideration of internal and external user requirements).

Fig. 1

The competent decision makers for the real estate management control the operative real estate activities which are rendered normally decentralized and primarily under utilization of external service companies.

To bring about an optimal coordination between real estate strategies and general competition strategies of a company or its business segments with a view to an improvement of the efficiency and thus, of the competitiveness of the total system.

Areas of responsibility in the Corporate Real Estate:

At the beginning of the realization of the CRE in an industrial society the most large-scale but most important step has to be fulfilled in the form of an inventory in which all objects, areas and buildings have to be recorded systematically and herewith, a valuation of the stock has to be executed according to the market criterions (e.g. comparable rents) and use (e.g. production hall).

When all objects are recorded the portfolio has to be separated systematically into operating and not operating (expendable) areas and buildings.

Expendable areas and buildings will be allocated to the sale (direct exploitation) or to the project development (classification in corresponding exploitation models) on conditions of an exploitation management. For operating areas and building plants an internal rent will be introduced. Here, it is important that the incidental expenses will be accounted for user-specific (possibly without allinclusive prices). In case of internal rents it has to be paid attention to the fact that these rents have to be levied analogically to comparable market conditions and have to be adjusted to comparable rents of the regions in corresponding intervals.

Later on an optimization of the used portfolio will be executed. By project development (PE) the expendable areas should be allocated to exploitation according to corresponding version models. The objective of this is to run the different stages of the increase in value in the added value chain in order to generate a maximum return.

By a correspondingly organized Facility Management (FM) a cost optimization should be executed for all operating objects with the objective of a cost reduction.

The number of enterprises which run an active real estate management is slowly but steadily increasing. We have to mention here IBM, American Express, BASF, Deutsche Bank AG a.s.o..

The “Union Pacific Railroad Company” let valued 22 000 miles of land alongside the railroad. The result of this examination has been unused parts of land with an amount of about 250 to 300 million Dollars with which the revenue of a company could increase by 15 to 20 %.

Annually “the Mellon Bank” raised 150-160 million Dollars as expenses for office use. Advisors have valued more than 30 locations in the Northeast of America new and have obtained cost reductions of about 20 % by sale, change of utilization and external renting of almost 40.000 m².

ABB (Asea Brown Boveri), an international electronics company with 42 million m² of land and 12 million m² of useable floor space in 33 states has reduced its portfolio of useable floor space in Swiss by 40 % by using active real estate management.

*May, Alexander/Eschenbaum, Friedrich/ Breitenstein, Oliver: Projektentwicklung im CRE Management,

Leitfaden zur Ausschöpfung von Wertsteigerungs- und Kostensenkungspotentialen im

Flächenmanagement, Berlin, Heidelberg, New York 1998, Springer Verlag, ISBN 3-540-63489-4